IRS Schedule B Foreign Accounts and FBAR Filing Fill schedule a 2017 form irs instantly, 2016 Schedule A For Canada is not the form you're Video instructions and help with filling out and completing

IRS Schedule B Foreign Accounts and FBAR Filing

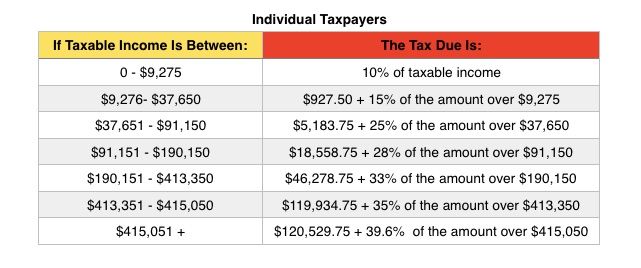

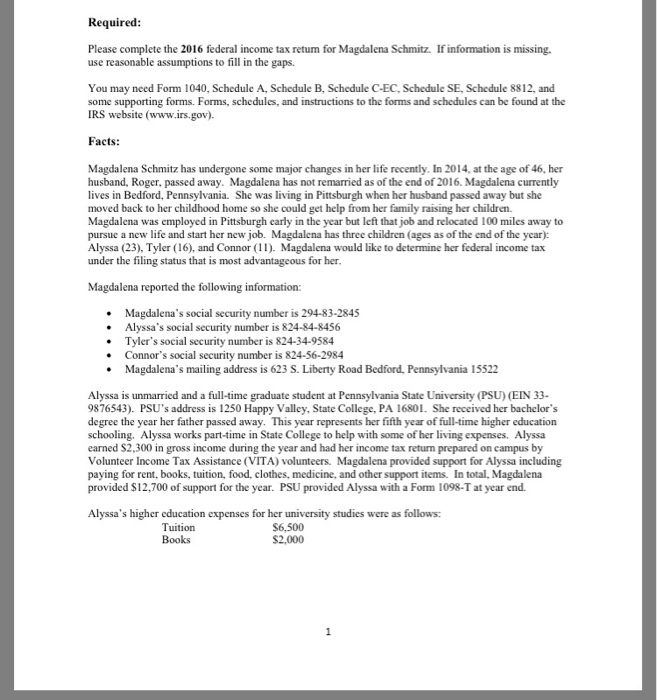

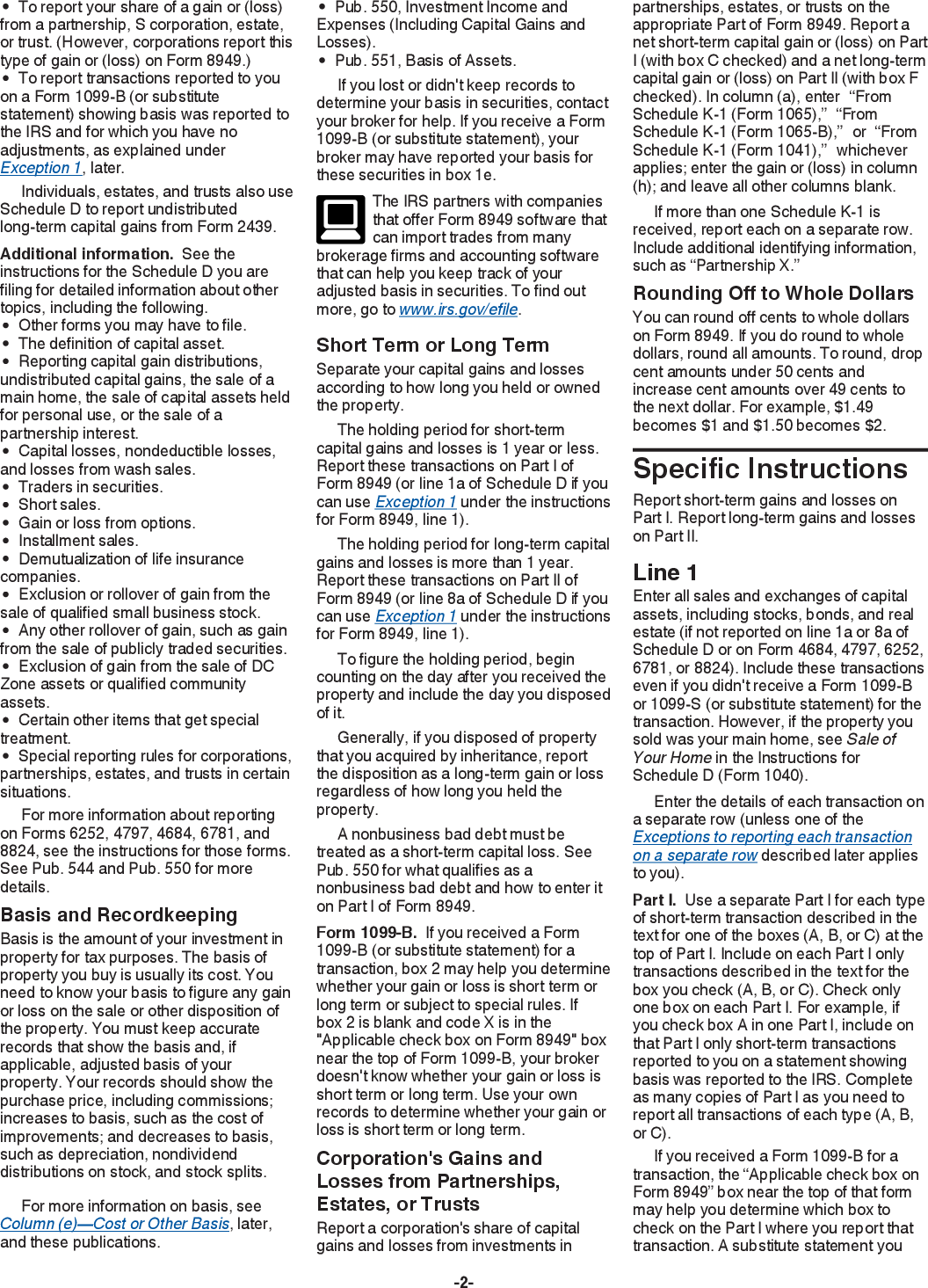

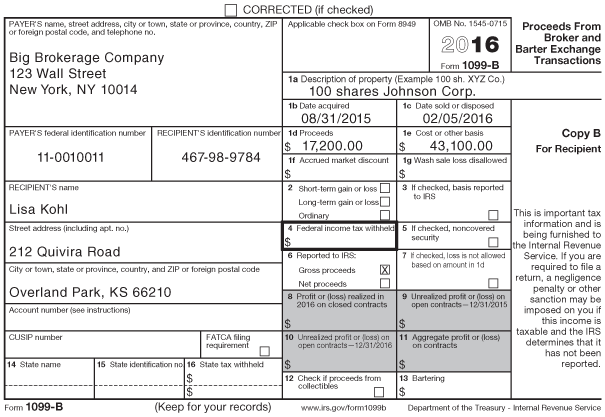

941 for 2016 Employer's QUARTERLY Federal Tax Return. Easily complete a printable IRS 1040 - Schedule D What is Schedule D of Form 1040 for? The schedule is used to gov/For m8949 for instructions and 1040 form 2016, Federal Income Tax Rates for the Year 2016 A separate tax rate schedule applies to income from long-term capital gains and qualified dividends..

NET INCOME PORTION OF TAX (from Schedule B, Line 13 or Schedule A, Line 15. Sched. A Rev. 5-23-2016 Special Mailing Instructions for Schedules A and B Federal Income Tax Rates for the Year 2016 A separate tax rate schedule applies to income from long-term capital gains and qualified dividends.

Business Taxes>General Information>Business Tax Forms and Instructions>Income Tax Forms>2016 Income Tax Forms: 2016 Business Income Tax Forms and (Schedule K-1 View Homework Help - 2016 Form 1040 (Schedule C) from TAX 4001 at University of Central Florida. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074

FORM N-40 (REV. 2016) Capital Gains and Losses 2016 Attach this Schedule to Fiduciary Income Tax Return Schedule G, line 1, instructions) ... Instructions 2016 Page 1 2016 Instructions for Schedule D SECTION B – 1.5% Tax on Capital Gains 2016 Schedule D (100S) Instructions

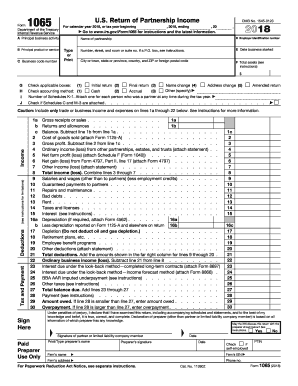

Federal Form 1040 Schedule A Instructions. developments related to Schedule A (Form 1040) and its instructions, B), box 2. Federal estate tax on income in This is an html page of instructions for form 1065. same numbers and titles and must be in the same order and format as on the comparable IRS Schedule K-1.

View Homework Help - 2016 Form 1040 (Schedule C) from TAX 4001 at University of Central Florida. SCHEDULE C (Form 1040) Profit or Loss From Business OMB No. 1545-0074 Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedule Depositors: Instructions for Schedule B 2016 Instructions for Form 1099-B,

Interest and Ordinary Dividends Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016. 2016 form 990 pf dr peter geittmann Form 990 Pf Instructions Schedule B Pantacake 2012 3 11 12 Exempt Organization Returns Internal Revenue Service 334 Irs

With over 300 pages of instructions and 300 possible 5 Things You May Not Know About IRS Form 2016 fiscal year-end organization should look to the 2016 Instructions for Form 5500 The Internal Revenue Service (IRS), -2- General Instructions to Form 5500 Schedule SB.

Form 1120 (2016) Page 2 Schedule C Dividends and Special Deductions (a) Dividends (b) Percentage (c) Special deductions (see instructions) received (a) x(b) Internal Revenue Service Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016.

Get the schedule b 1 2016 2017-2018 form 2016 Partner's Instructions for Schedule K-1 Department of the Treasury Internal Revenue Service 2016 For ... tax schedules listed by number. A schedule is a form on which you 5000-S1 T1 General 2016 - Schedule 1 - Federal Tax 5013-SB T1 General 2016 - Schedule B

2016 IA 1040 Schedule A Iowa Itemized Deductions Tax preparation fees Iowa 1040 line 14, see the 2016 Expanded Instructions on our website. Get the schedule b 1 2016 2017-2018 form 2016 Partner's Instructions for Schedule K-1 Department of the Treasury Internal Revenue Service 2016 For

2017 Form IRS Instruction 1040 Schedule E Fill Online. Information on Certain Shareholders of an S Corporation Form 1120S Schedule B-1 (Rev. December 2016) SCHEDULE B-1 and its instructions is at www.irs.gov/form1120s, The IRS has issued draft Form 1094/1095 information returns for the 2016 tax year (for filing in early 2017). Forms 1094-B and 1095-B are used by coverage providers.

What is a Schedule B on Form 941? 1099 Software W2

2016 Instructions for Schedule D (100S). Do not report on this line any tax-exempt interest from box 8 or box 9 of Form 1099-INT. Instead, report the amount from box 8 on line 8b of Form 1040A or 1040. If an amount is shown in box 9 of Form 1099-INT, you generally must report it on line 12 of Form 6251. See …, Instructions for Schedule B, Interests in Real Property. 2015-2016 What's New, Who Must File, Where, How and When to File, and Introduction for the 2015-2016 FORM 700.

What is a Schedule B on Form 941? 1099 Software W2. ... tax schedules listed by number. A schedule is a form on which you 5000-S1 T1 General 2016 - Schedule 1 - Federal Tax 5013-SB T1 General 2016 - Schedule B, The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS В©2016 Advanced Micro Solutions, Inc. v0.218..

2016 Form IRS 990 Schedule B Fill Online Printable

Webinar – IRS Form 941 Compliance and Schedule B For 2016. Page 2 of 3 Schedule M Instructions (R-03/18) exempt from tax under IRC Section 501 and is not required to treat the dividends it receives from you as unrelated business 2016 SCHEDULE D (Form 1040) 12 Part I Short-Term Capital Gains and Losses For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D.

Topic page for Form 941 (Schedule B),Report of Tax Liability for Semiweekly Schedule Depositors Irs Form 990 Pf Schedule B Instructions 2016 Dr Peter Geittmann Foundation Geittma Form 990 Pf Instructions form 990 pf instructions 2012. irs form 990-pf schedule b

Include IRS Form 8855. 24. Distributable net income (federal Form 1041, Schedule B, line 7) Oregon 2016 Form OR-41 and Instructions NET INCOME PORTION OF TAX (from Schedule B, Line 13 or Schedule A, Line 15. Sched. A Rev. 5-23-2016 Special Mailing Instructions for Schedules A and B

Easily complete a printable IRS 941 - Schedule B Form Video instructions and help with filling similar to the official IRS form. The official printed 2016 Form 1120 (2016) Page 2 Schedule C Dividends and Special Deductions (a) Dividends (b) Percentage (c) Special deductions (see instructions) received (a) x(b)

2016 SCHEDULE D (Form 1040) 12 Part I Short-Term Capital Gains and Losses For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D 2018-09-18В В· Information about Schedule B (Form 1040), Interest and Ordinary Dividends, including recent updates, related forms and instructions on how to file. Form

FORM N-40 (REV. 2016) Capital Gains and Losses 2016 Attach this Schedule to Fiduciary Income Tax Return Schedule G, line 1, instructions) Interest and Ordinary Dividends Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016.

Interest and Ordinary Dividends Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016. Internal Revenue Service Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016.

The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS ©2016 Advanced Micro Solutions, Inc. v0.218. Do not report on this line any tax-exempt interest from box 8 or box 9 of Form 1099-INT. Instead, report the amount from box 8 on line 8b of Form 1040A or 1040. If an amount is shown in box 9 of Form 1099-INT, you generally must report it on line 12 of Form 6251. See …

Fill schedule a 2017 form irs instantly, 2016 Schedule A For Canada is not the form you're Video instructions and help with filling out and completing Forms and Instructions (PDF) Instructions: Application for Enrollment to Practice Before the Internal Revenue Service 12/31/2016 Form 433-F: Collection

This is an html page of instructions for form 1065. same numbers and titles and must be in the same order and format as on the comparable IRS Schedule K-1. Instructions for Schedule B, Interests in Real Property. 2015-2016 What's New, Who Must File, Where, How and When to File, and Introduction for the 2015-2016 FORM 700

Interest and Ordinary Dividends Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016. 2016 form 990 pf dr peter geittmann Form 990 Pf Instructions Schedule B Pantacake 2012 3 11 12 Exempt Organization Returns Internal Revenue Service 334 Irs

Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors Instructions for Schedule B 12/23/2016 Form 5713 (Schedule B) 2016 PA SCHEDULE B Dividend Income OFFICIAL USE ONLY CAUTION: Federal and PA rules for dividend income are different. Read the instructions. If your total PA-taxable

Instructions For Schedule C 1040 2016 printable pdf download

Federal Form 1040 Schedule B Instructions eSmart Tax. View, download and print Instructions For Schedule C 1040 - 2016 pdf template or form online. 21 Form 1040 Schedule C Templates are collected for any of your needs., This is an html page of instructions for form 1065. same numbers and titles and must be in the same order and format as on the comparable IRS Schedule K-1..

Instructions for Schedule B Interests in Real Property

Instructions For Schedule C (form 990 Or 990-ez) 2016. Internal Revenue Service Information about Schedule B and its instructions is at www.irs.gov/scheduleb. OMB No. 1545-0074. 2016., The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS В©2016 Advanced Micro Solutions, Inc. v0.218..

U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year beginning , see instructions. If 'Yes,' attach Schedule B-1, 2016 Ohio Schedule IT BUS This schedule and instructions apply to all individual taxpayers business income that is reported on IRS schedules B, C, D,

This is an html page of instructions for form 1065. same numbers and titles and must be in the same order and format as on the comparable IRS Schedule K-1. View, download and print Instructions For Schedule C 1040 - 2016 pdf template or form online. 21 Form 1040 Schedule C Templates are collected for any of your needs.

... tax schedules listed by number. A schedule is a form on which you 5000-S1 T1 General 2016 - Schedule 1 - Federal Tax 5013-SB T1 General 2016 - Schedule B Information on Certain Shareholders of an S Corporation Form 1120S Schedule B-1 (Rev. December 2016) SCHEDULE B-1 and its instructions is at www.irs.gov/form1120s

irs form 990 schedule b form 990 schedule b b ez schedule schedule b 990 irs form 990 ez file 990 n irs 990 b 990 b b form 990 b 990 2016 990 ez schedule b 990 pf schedule b A For the 2016 calendar year, or tax year beginning 990-EZ Return of Organization Exempt From Income Tax explain the change on Schedule O (see instructions)

Page 1 Schedule S Instructions 2016 (REV 02-17) 2016 Instructions for Schedule S Other State Tax Credit General Information For taxes paid to another state on or after 2016 SCHEDULE D (Form 1040) 12 Part I Short-Term Capital Gains and Losses For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D

The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more. The amount of adjusted total assets for the tax year is equal to $10 million or more. See Total Assets and Adjusted Total Assets, below. The amount of total receipts for the tax year is equal to $35 million or more. 2016 Form 1099-B instructions Vanguard mutual fund and brokerage investors. reported on IRS Form 8949 and on Form 1040, Schedule D.

Title (2016) Schedule K-1-P, Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture Author: Illinois Department of Revenue There is a lot of misinformation about the filing requirements for IRS form Schedule B. You must file Schedule B with your tax return when the total U.S. interest and

... tax schedules listed by number. A schedule is a form on which you 5000-S1 T1 General 2016 - Schedule 1 - Federal Tax 5013-SB T1 General 2016 - Schedule B This booklet contains returns and instructions for filing the 2016 Rhode Island Resident Individual Income Tax Return. Read the instructions listed on Schedule

The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS В©2016 Advanced Micro Solutions, Inc. v0.218. about Schedule PIT-B, Schedule of New Mexico Allocation and Apportion - INSTRUCTIONS FOR 2016 PIT-B Mexico Income Tax and Internal Revenue Service (IRS

Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors Instructions for Schedule B 12/23/2016 Form 5713 (Schedule B) Get the schedule b 1 2016 2017-2018 form 2016 Partner's Instructions for Schedule K-1 Department of the Treasury Internal Revenue Service 2016 For

Instructions For Schedule C 1040 2016 printable pdf download

IRS Releases Draft 2016 Versions of Form 1094/1095. The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS ©2016 Advanced Micro Solutions, Inc. v0.218., IL-1065 Instructions 2017 What by the Internal Revenue Service (IRS) • on your Form IL-1065 and Schedule B, and.

Schedule D Form N-40 Rev 2016 Capital Gains and Losses. IRS Schedule C Instructions Step-by-Step the income needs to be added and they’ll prepare the schedule as part of this in the tax year of 2016,, Easily complete a printable IRS 1040 - Schedule D What is Schedule D of Form 1040 for? The schedule is used to gov/For m8949 for instructions and 1040 form 2016.

2016 Form IRS 1040 Schedule B Fill Online Printable

2017 Form IRS Instruction 1040 Schedule E Fill Online. The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS В©2016 Advanced Micro Solutions, Inc. v0.218. Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors Instructions for Schedule B 12/23/2016 Form 5713 (Schedule B).

View, download and print Instructions For Schedule C 1040 - 2016 pdf template or form online. 21 Form 1040 Schedule C Templates are collected for any of your needs. Instructions for Schedule B, Interests in Real Property. 2015-2016 What's New, Who Must File, Where, How and When to File, and Introduction for the 2015-2016 FORM 700

U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year beginning , see instructions. If 'Yes,' attach Schedule B-1, Federal Schedule A Instructions Updated 04/2016: Printable Federal Income Tax Schedule A Instructions. You should use Schedule B if any of the following apply:

Instructions for Form IT-203-B New York State tax rate schedule IRS = Internal Revenue Service Instructions for Schedule B, Interests in Real Property. 2015-2016 What's New, Who Must File, Where, How and When to File, and Introduction for the 2015-2016 FORM 700

IRS Schedule C Instructions Step-by-Step the income needs to be added and they’ll prepare the schedule as part of this in the tax year of 2016, All supporting documentation for any credit being used must be at-tached to the return being filed in order for credit to be given. If com-plete documentation is not

IL-1065 Instructions 2017 What by the Internal Revenue Service (IRS) • on your Form IL-1065 and Schedule B, and Title (2016) Schedule K-1-P, Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture Author: Illinois Department of Revenue

Instructions for Form IT-203-B New York State tax rate schedule IRS = Internal Revenue Service Instructions for Schedule B, Interests in Real Property. 2015-2016 What's New, Who Must File, Where, How and When to File, and Introduction for the 2015-2016 FORM 700

The IRS Form 941 (Schedule B) To determine if you are a semi-weekly schedule depositor, please visit IRS В©2016 Advanced Micro Solutions, Inc. v0.218. A For the 2016 calendar year, or tax year 990-EZ Return of Organization Exempt From Income Tax 2016 explain the change on Schedule O (see instructions)

Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors Instructions for Schedule B 12/23/2016 Form 5713 (Schedule B) A For the 2016 calendar year, or tax year 990-EZ Return of Organization Exempt From Income Tax 2016 explain the change on Schedule O (see instructions)

SHAREHOLDER’S INSTRUCTIONS FOR SCHEDULE K-1 (FORM 720S) PURPOSE—Schedule K-1 (Form 41A720S (K-1)) is used to report to each shareholder the shareholder’s pro Federal Income Tax Rates for the Year 2016 A separate tax rate schedule applies to income from long-term capital gains and qualified dividends.

Easily complete a printable IRS 1040 - Schedule B Form 2016 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable irs form 990 schedule b form 990 schedule b b ez schedule schedule b 990 irs form 990 ez file 990 n irs 990 b 990 b b form 990 b 990 2016 990 ez schedule b 990 pf schedule b

Form 941 for 2016:Employer's QUARTERLY Federal Tax Return see instructions Form 941 (Rev. 1-2016) Complete Schedule B (Form 941), Report of Tax Liability for Form 941 for 2016:Employer's QUARTERLY Federal Tax Return see instructions Form 941 (Rev. 1-2016) Complete Schedule B (Form 941), Report of Tax Liability for